michigan corporate tax forms 1065 withdraws and distributions box l We're excited to announce our newest series of TurboTax Community Tax . Steel Sheet Metal Fabrication Services. Upload your CAD files to get an instant online steel fabrication quote on custom formed steel sheet metal prototypes and production parts. Lead times as fast as days and free standard shipping on all US orders.

0 · 1065 k 1 withdrawals

1 · 1065 k 1 distributions

With CNC there would be no need for the compound. The use of Z and X in tandem can achieve everything that the compound can do and more. .

There is no reporting required when distributions do not exceed your basis. However, you will need to report the liquidating distribution figure and cost basis on form 8949 and Sch D, but .There is no reporting required when distributions do not exceed your basis. .We're excited to announce our newest series of TurboTax Community Tax .What are the tax deadline extensions for those affected by natural disasters? .

We would like to show you a description here but the site won’t allow us.

Your borrower showed ,000 on 1065 K-1 Box L Withdrawals and Distributions and only ,500 on Line 19 with a code of A. They did not have other Line 19 amounts. If the remaining ,500 had been property .The CIT imposes a 6% corporate income tax on C corporations and taxpayers taxed as corporations federally. The CIT has one credit, the small business alternative credit, which offers an alternate tax rate of 1.8% of adjusted . Yes, the amount for Withdrawals & distributions on Schedule K-1 is always reported as a negative number and should be entered the same way in TurboTax.

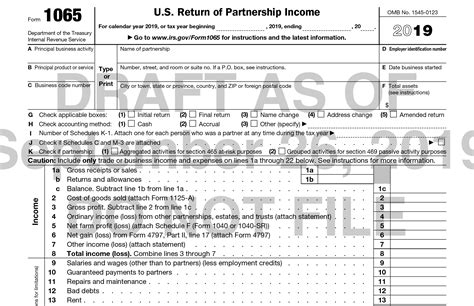

I am filing Form 1065 for an LLC filing as a partnership and I am having trouble getting the Schedule L to balance based on the balance sheet. The discrepancy involves .

Schedule L - Balance Sheets per Books is the section in Form 1065 - U.S. Return of Partnership Income where the partnership reports to the IRS their Balance Sheet as found in the .Overview. Negative “tax basis capital” generally exists when a partnership allocates tax deductions or losses or makes distributions to a partner in excess of the partner’s tax basis .Box 19 of the K-1 (1065) records distributions made to you, the partner or member, during the year. The distributions could have been cash or in other types of property. Think of a . Failing to file Form 1065 can result in a penalty of 5 per month for each partner in the partnership for up to 12 months. That can add up quickly, so filing the form on time is .

Those distributions should be reported in box 19 of the K-1. They should also show up in Box L Partner's Capital Account Analysis on the line that says Withdrawals and distributions. Are you .The federal Tax Cuts and Jobs Act (TCJA) of 2017 limits . business losses that are included in adjusted gross income (AGI) for 2021 and future tax years. The limitation is computed by aggregating business income and business losses. If the computation results in a loss, the Internal . Revenue Code (IRC) 461(l) limits business losses in2021 Michigan Business Tax Forms 2022 Michigan Business Tax Forms . Premature separation, withdrawal, or discontinuance of a plan prior to the earliest date the recipient could have retired under the provisions of the plan. .of interest income as reported on Form L-1065, Schedule B11, column 1. Line 6. Dividend income. Enter the amount of the partner’s taxable share of dividend income as reported on Form L-1065, Sch. B11, column 2. Line 7. Royalties. Enter the amount of the partner’s taxable share of royalties as reported on Form L-1065, Schedule B11, column 8 .

If no U.S. Form 1065 is required, you may use Form 5678, Michigan Signed Distribution Statement for Joint Owners of Farmland Development Rights Agreements to show percentage of income or ownership. Life Estate: A person in possession of the property under a life estate with remainder interest to another person may claim all the property taxes .

1065 k 1 withdrawals

1065 k 1 distributions

completing a Michigan Business Tax return for calendar year 2019 or a fiscal year ending in 2020. E-filing your return is easy, fast, and secure! . reported on a schedule K-1 Form 1065 as self-employment . and check the “Amended” box in the upper-right corner of the return, and attach a separate sheet explaining .

Every partnership with business activity in the City of Detroit, whether or not an office or place of business was maintained in the city, is required to file an annual return using the City of Detroit Income Tax Partnership Return (Form 5458).. Syndicates, joint ventures, pools and like organizations along with LLCs electing to be taxed as partnerships at the federal level will also .

Partner's Share of Income (Loss) From an Electing Large Partnership 2023 Schedule K-1 (Form 1065) 651123 Final K-1 2023 Schedule K-1 (Form 1065) Department of the Treasury Internal Revenue Service Part III Partner’s Share of Current Year Income, Deductions, Credits, and Other Items / 2023 / / ending / Partner’s Share of Income, Deductions, See separate instructions.

Income Tax Department . PO Box 109 . Grand Rapids, Michigan 49501-0109. RATE . FILING . 2020 GRAND RAPIDS PARTNERSHIP INCOME TAX FORM AND INSTRUCTIONS For partnerships with business activity in the City of Grand Rapids TAX FORMS . TAX RATES AND EXEMPTION VALUE . 1.5% is the tax rate for a partner who is a resident individual, .

A draw could be just a distribution. Distributions are reported on the Sch K-1(currently line 19) Distributions may or may not be taxable. This depends on the member's tax basis. As long as a member's tax basis is positive (or does not go below zero), there are no tax implications to the distribution.Income Tax Department . PO Box 109 . Grand Rapids, Michigan 49501-0109. RATE Se. 202. 3. GRAND RAPIDS. PARTNERSHIP INCOME TAX FORM AND INSTRUCTIONS. For partnerships with business activity in the City of Grand Rapids. TAX FORMS . TAX RATES AND EXEMPTION VALUE . 1.5% is the tax rate for a partner who is a resident individual, corporation or .Emergency-related state tax relief available for taxpayers located in four southwest Michigan Counties impacted by May 2024 storms.Form Number. Form Name. Description. 5447: City of Detroit Corporate Income Tax Return Forms and Instructions Book: This book contains most of the forms listed below to complete a 2023 City of Detroit Corporate Income Tax Return.

Qualified Pension Distribution Requirements . 2022 Michigan Business Tax Forms 2023 Michigan Business Tax Forms . This reports any debt canceled by your lender. The amount of the debt canceled is shown in box 2; Form 1099-A: Acquisition of Abandonment of Secured Property. This is used to compute your federal gain or loss if your home is .Emergency-related state tax relief available for taxpayers located in four southwest Michigan Counties impacted by May 2024 storms.

reported on a schedule K-1 Form 1065 as self-employment . Form 4600 and check the “Amended” box in the upper-right corner of the return. To amend an annual return for years prior to 2012, complete . 4600, 2016 Michigan Business Tax Forms and .Back Notices . Notice Regarding Rescission of Rule Governing Food for Human Consumption Tax Rate Calculation on Gross Premiums Attributable to Qualified Health Plans for Tax Year 2024Form 163 can also be submitted electronically on Michigan Treasury Online at mto.treasury.michigan.gov. 5156, Request for Tax Clearance Application 163, Notice of Change or Discontinuance

Qualified Pension Distribution Requirements Income Tax Self-Service. Go to Income Tax Self-Service Where's My Refund? Business Taxes. Go to Business Taxes . 2022 Michigan Business Tax Forms 2023 Michigan Business Tax Forms .Limited dividends or other distributions made to owners of the QAHP 19f. 00 % 00 00 : g. QAHP Deduction. . Michigan Department of Treasury, PO Box 30783, Lansing MI 48909: Michigan Department of Treasury, PO Box 30113, Lansing MI 48909 . Instructions for Form 4567 Michigan Business Tax (MBT) Annual Return :Every corporation with an annual corporate income tax liability of more than 0 must make estimated tax payments. Each payment must approximate the taxpayer's tax liability for the quarter or 25 percent of the estimated annual liability.

Schedule K-1 (Form EL-1065) – Partner’s Share of Income, Exclusions Deductions, Credits and Tax Paid Page 5 Schedule K-1 (Form EL-1065) – Partner Instructions Page 5 Schedule RZ (Form EL-1065) – Partnership Renaissance Zone Deduction Page 5 Schedule N – Supporting Notes and Schedules (Attachment 22) Page 6 The most common reason for Form 1065 Schedule K-1, Item L, partners' capital account analysis being blank is that Form 1065, Schedule B, Question 6 is marked "Y . Check the box labeled Schedules L, M-1, and M-2: 1=force, 2=when applicable [Override]. . Partnership capital account analysis and Schedule M-2 in ProConnect Tax.

Box 19 of the K-1 (1065) records distributions made to you, the partner or member, during the year. The distributions could have been cash or in other types of property. Think of a distribution as being similar to a dividend as they are a reduction of capital/equity in the business.

See Also: 2024 Withholding Tax Forms If you received a Letter of Inquiry Regarding Annual Return for the return period of 2024, visit Michigan Treasury Online (MTO) to file or access the 2024 Sales, Use and Withholding Taxes Annual Return fillable form.. Fillable Forms Disclaimer Many tax forms can now be completed on-line for printing and mailing. Currently, there is no . Michigan’s 2023 tax return forms already include the new retirement and pension benefit subtractions. The key point here is that your retirement distribution must come from a recognized retirement plan to qualify for these benefits. There are specific rules for employer and individual plans, so make sure your distributions meet these criteria . Lansing, MI 48909-7671 www.michigan.gov/ors Fax: 517-284-4416 Department of Technology, Management & Budget

Qualified Pension Distribution Requirements Income Tax Self-Service. Go to Income Tax Self-Service Where's My Refund? Business Taxes. Go to Business Taxes . 2022 Michigan Business Tax Forms 2023 Michigan Business Tax Forms .

Generally, Xometry is capable of manufacturing sheet metal parts up to 1⁄4” (6.35mm) in thickness, but this tolerance mainly depends on the geometry of the part. When considering .

michigan corporate tax forms 1065 withdraws and distributions box l|1065 k 1 distributions